The wellness industry is on fire.

Global wellness reached $1.8 trillion in 2024, with the U.S. wellness market alone hitting $480 billion. Consumers are spending more on health, prevention, and holistic well-being than ever before. From functional beverages to adaptogens, from gut health supplements to sleep support formulas, wellness has moved from niche to mainstream.

Yet here’s the paradox: while the category explodes, most wellness brands remain stubbornly small. They find passionate early adopters, build loyal communities, and create genuinely transformative products, then plateau at $5M or $10M in revenue, unable to break through to the next level.

After two decades building food, beverage, and wellness brands, I’ve watched this pattern repeat itself dozens of times. The wellness brands that scale aren’t necessarily those with the best formulations or the most authentic founder stories. They’re the ones that master a different game entirely.

Let me show you what’s really separating wellness winners from the brands stuck in perpetual “emerging” status—and more importantly, how to know which side you’re on.

The Wellness Brand Paradox: Why “Better” Doesn’t Mean “Bigger”

Here’s what most wellness founders believe: If we create a superior product and tell our story authentically, growth will follow.

It’s a beautiful theory. It’s also dangerously incomplete.

The wellness consumer is fundamentally different from the food or beverage shopper. They’re not just buying a product—they’re buying into a lifestyle, a belief system, a version of themselves they’re trying to become. This creates both massive opportunity and unique challenges.

The opportunity: When you get it right, wellness brands create cult-like loyalty. Customers don’t just buy—they evangelize. They post on social media. They gift your products. They become part of your brand’s identity.

The challenge: This same emotional investment makes wellness consumers incredibly discerning. They research ingredients obsessively. They demand transparency. They’re skeptical of “big wellness” and quick to call out anything that feels inauthentic. And they’re willing to pay premium prices—but only if you can prove you’re worth it.

The result? A category where brand positioning isn’t just important—it’s existential.

The Three Wellness Archetypes (And Why Most Brands Pick Wrong)

Every successful wellness brand falls into one of three strategic archetypes. The brands that struggle? They’re usually trying to be all three at once.

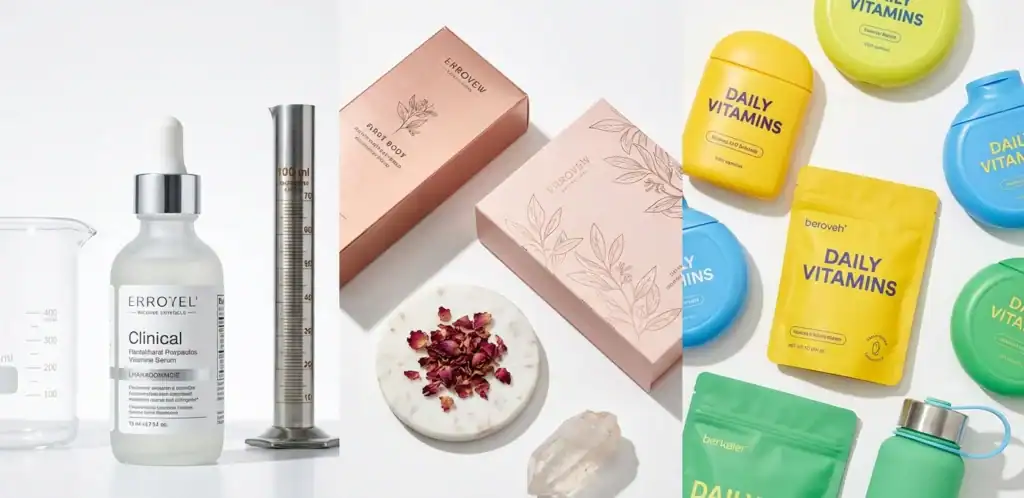

Archetype 1: The Science-Backed Authority

Who they are: Brands built on clinical research, bioavailability, and measurable outcomes. Think AG1, Momentous, or Thorne.

Their superpower: Credibility through evidence. They can charge premium prices because they have the data to back it up.

Who they win with: Biohackers, high-performers, medical professionals, and consumers who want functional results over emotional resonance.

The trap: Becoming so clinical that you lose the aspiration and lifestyle appeal that drives wellness purchases. If you sound like a supplement facts panel, you’ve gone too far.

Archetype 2: The Lifestyle-First Aspirational

Who they are: Brands that sell a feeling, an identity, a version of who you could become. Think Goop, Sakara, or Moon Juice.

Their superpower: Creating desire through aesthetics, community, and cultural cachet. They’re buying into a tribe.

Who they win with: Consumers who view wellness as self-expression, status, and identity. They want products that look good on their countertop and in their Instagram stories.

The trap: Being dismissed as “overpriced woo-woo” by science-focused consumers. If you can’t back up your claims with something beyond vibes, you’re vulnerable to skepticism and competition.

Archetype 3: The Accessible Wellness Democratizer

Who they are: Brands making wellness affordable and approachable for the mainstream. Think Olly, Vital Proteins (post-Costco distribution), or HUM Nutrition.

Their superpower: Taking wellness mainstream by removing barriers to entry—price, education, and intimidation factor.

Who they win with: Wellness-curious consumers who want to dip their toes in without the premium price tag or steep learning curve.

The trap: Becoming so accessible that you lose premium positioning and margin. You end up competing on price in a race to the bottom.

Here’s the critical insight: None of these archetypes is inherently better than the others. But trying to be all three is the fastest way to be nothing at all.

Most wellness brands I meet are positioned somewhere in the murky middle—”science-backed” but also “aspirational” and “accessible.” This sounds strategic. It’s actually strategic suicide. You end up being too expensive for the democratizers’ audience, too fluffy for the science seekers, and not distinctive enough for the lifestyle buyers.

The first step to scaling a wellness brand is choosing your archetype—and having the discipline to say no to everything else.

Why Wellness Brands Fail the “Shelf Test”

Walk into any Whole Foods, Erewhon, or natural products store and scan the wellness section. You’ll see dozens of brands that look remarkably similar:

- Minimalist packaging in muted earth tones

- Botanical illustrations or abstract patterns

- Claims about “clean ingredients” and “functional benefits”

- Price points between $29.99 and $49.99

- Positioning somewhere between “backed by science” and “inspired by nature”

Now here’s the brutal question: If I covered up the brand names, could you tell them apart?

For most wellness brands, the answer is no.

This is what I call failing the “Shelf Test”—the inability to communicate your unique value proposition in 3 seconds when a consumer is standing in front of a shelf of similar-looking products.

Food and beverage brands have a slight advantage here. A sparkling water can tell you it’s “lemon-flavored” or “zero sugar” at a glance. A protein bar can show you it has “20g protein.”

But wellness brands are selling benefits you can’t photograph: better sleep, reduced stress, improved gut health, enhanced focus. You’re asking consumers to trust that your blend of adaptogens or your delivery mechanism or your sourcing story makes you worth 2-3x the price of competitors.

This is why brand strategy matters more in wellness than almost any other category.

You can’t just have good ingredients and clean formulations. You need a positioning so clear that a time-starved consumer glancing at your product for 3 seconds understands exactly:

- What outcome you deliver

- Why you’re different from the seven other brands making similar claims

- Why you’re worth the premium price

If your positioning doesn’t answer all three in those 3 seconds, you’re leaving money on the shelf.

The Digital-First Delusion (And Why Wellness Brands Need Retail More Than They Think)

A decade ago, the conventional wisdom was that wellness brands should start DTC, build a community, and only go into retail once they had proof of concept.

Today, that playbook is broken.

DTC customer acquisition costs have exploded. Facebook CPMs are up 3-4x from 2019. iOS privacy changes gutted targeting capabilities. And wellness consumers—especially those willing to pay premium prices—now expect to find brands in curated retail environments as a mark of legitimacy.

Here’s the uncomfortable truth: In 2025, pure DTC wellness brands often struggle to scale beyond $5M-$10M in revenue. They hit a ceiling where customer acquisition costs exceed lifetime value, and they can’t justify the paid media spend needed to break through.

Meanwhile, wellness brands with strong retail presence are capturing the benefits of:

- Credibility through curation: Being carried by Erewhon, Whole Foods, or The Vitamin Shoppe signals quality and vetting

- Discovery by category shoppers: Consumers browsing for gut health solutions find you organically

- Purchase frequency: Retail drives trial and repeat in ways DTC struggles to replicate

- Cash flow: Retail wholesale orders provide working capital that DTC subscriptions take months to generate

But—and this is crucial—retail only works if you’ve nailed your positioning first.

The wellness brands failing in retail are those that treated it as “just another channel” without adapting their strategy. They took their DTC brand, slapped it on a shelf, and wondered why it didn’t work.

Retail wellness consumers are different from DTC wellness consumers:

- Less product education: They have 30 seconds to make a decision, not 5 minutes to read your landing page

- More price sensitive: They’re comparing you to adjacent products on the shelf, not discovering you through targeted ads

- Lower intent: They might not have been looking for your category at all—you need to create need in the moment

- Higher skepticism: Without your website’s social proof and testimonials, they need other trust signals

The brands winning at wellness retail have adapted their positioning, packaging, and education strategy specifically for the shelf—while maintaining brand consistency.

Where Most Wellness Brands Actually Struggle: The Six Hidden Gaps

After working with dozens of wellness brands, I’ve identified six specific gaps that consistently hold brands back from scaling. These aren’t about product quality or founder passion—those are table stakes. These are strategic and operational gaps that create invisible ceilings.

Gap 1: Education vs. Conversion Misalignment

The problem: Wellness products often require significant consumer education. But most brands dump all that education into the moment of purchase decision, overwhelming consumers and killing conversion.

What it looks like: Your product packaging is covered in tiny text explaining bioavailability, synergistic ingredients, and mechanism of action. Your retail shelf talker is a wall of text. Your Amazon listing is 2,000 words of dense explanation.

Why it fails: Consumers don’t read paragraphs when they’re shopping. They skim, grab, and move on. If your product requires a TED talk to understand, you’ve lost.

What winners do: They separate education from conversion. Education happens through content marketing, email sequences, and social media before the consumer ever sees the product. By the time someone is looking at your product on a shelf or website, they already understand the category and just need to know why you’re the best choice.

Gap 2: Benefits vs. Ingredients Confusion

The problem: Wellness brands fall in love with their ingredient stories and forget that consumers buy outcomes, not inputs.

What it looks like: Your product is called “Ashwagandha + Rhodiola Complex” instead of “Stress Relief Formula.” Your packaging highlights “500mg KSM-66®” instead of “Fall asleep faster, stay asleep longer.”

Why it fails: Ingredient awareness is growing, but most consumers still don’t know what ashwagandha does or why it matters. They do know they want to feel less stressed or sleep better.

What winners do: They lead with benefits and back them up with ingredients. “Sleep Support Formula*—Featuring clinically-studied Ashwagandha KSM-66®*” communicates both what you get (better sleep) and why you should trust it (clinical backing).

Gap 3: Premium Pricing Without Premium Justification

The problem: Wellness brands charge premium prices because their costs are high (quality ingredients, small batch production, clean formulations). But they fail to communicate why the premium is justified.

What it looks like: You’re $45 while competitors are $29, but your packaging doesn’t immediately communicate what makes you worth 55% more.

Why it fails: Premium pricing requires premium positioning. If you can’t instantly communicate your differentiation, consumers default to price comparison and you lose.

What winners do: They build premium justification into every touchpoint: sustainably sourced ingredients from specific origins, third-party testing and certifications visible on pack, proprietary blends or delivery mechanisms, clinical backing with actual study results, transparent supply chain and manufacturing processes.

Gap 4: Community vs. Commerce Confusion

The problem: Wellness brands build amazing communities—engaged social followings, passionate advocates, active Discord servers—but struggle to convert community into commerce.

What it looks like: You have 50K Instagram followers but $2M in revenue. Your engagement rate is through the roof but your conversion rate is dismal. You’re spending more time managing community than driving sales.

Why it fails: Community for community’s sake doesn’t pay the bills. If your social metrics don’t connect to business metrics, you’ve built a hobby, not a business.

What winners do: They use community strategically to drive three specific outcomes: user-generated content for social proof, word-of-mouth acquisition to lower CAC, feedback loops for product development. They measure community health by business impact, not engagement vanity metrics.

Gap 5: The Retail Readiness Illusion

The problem: Brands go into retail before they have the operational infrastructure, velocity drivers, or financial cushion to succeed.

What it looks like: You got placement at Whole Foods but didn’t budget for the slotting fees, promotional discounts, and inevitable payment terms. You can’t afford demos or sampling to drive velocity. Your margins are so thin that retailer markdowns destroy profitability.

Why it fails: Retail is a cash flow game as much as a brand game. If you’re not operationally and financially ready, you’ll crater even if consumers love your product.

What winners do: They use a staged approach, testing in high-velocity stores first, building operational muscle before expanding, using retail as a complement to DTC, not a replacement, ensuring they have 6-12 months of working capital for the retail ramp.

Gap 6: The Measurement Gap

The problem: Wellness brands measure the wrong things—or don’t measure anything at all.

What it looks like: You track social followers, email subscribers, and website traffic. But you don’t know your customer lifetime value, channel-specific CAC, velocity by retailer, or true product-level profitability.

Why it fails: You can’t optimize what you don’t measure. Without data, you’re making decisions based on gut feel in a category where margins are thin and competition is fierce.

What winners do: They build measurement infrastructure early: cohort-based LTV analysis by channel, product-level P&L including all allocated costs, retail velocity tracking by store, marketing attribution across the full funnel, subscription retention and churn drivers.

The Assessment: Where Does Your Wellness Brand Actually Stand?

By now you’re probably wondering: Which of these gaps apply to my brand?

The hard truth is that most wellness brands have multiple gaps—and often they’re interconnected. A pricing justification gap creates a retail readiness gap. A measurement gap prevents you from fixing your community-to-commerce gap.

The only way to break through is honest assessment of where you are today.

I’ve created a Brand Growth Readiness Assessment that evaluates wellness brands across all six areas I’ve covered—plus deeper into organizational capabilities, digital optimization, and strategic positioning.

It takes about 10 minutes to complete, and you’ll discover:

- Your Growth Readiness Score across 6 critical categories

- Your current Growth Stage (Foundation to Category Leader)

- Your Priority Focus Area (the gap holding you back most)

- Specific recommendations tailored to wellness brands

Download the Free Brand Growth Readiness Assessment and discover your path to category leadership.

Free Brand Growth Readiness Assessment

This is the same framework I use when wellness brands first engage with Yventure. It quickly identifies where the biggest leverage points are so you can prioritize your limited time and resources on what actually moves the needle.

If you’re a wellness brand founder reading this and thinking, “We need help with most of these,” you’re not alone. The gap between knowing what to do and having the capability to execute is where most brands get stuck.

That’s exactly why I built Yventure Strategy, to give wellness brands the strategic leadership and execution support they need without the overhead of a full-time CMO.

What Separates Wellness Winners from the 73% That Plateau

The wellness industry will keep growing. Consumer demand for products that support health, longevity, and holistic well-being isn’t going anywhere.

But the number of wellness brands will grow even faster. Competition is intensifying. Retail buyers are more selective. Consumers are more sophisticated and skeptical.

In this environment, having a great product is the price of entry, not a competitive advantage.

The brands that will break through to $25M, $50M, $100M+ in revenue are those that master the strategic and operational dimensions that most wellness founders don’t even realize they’re missing.

They don’t just create products, they create positioning.

They don’t just build community, they build commerce.

They don’t just chase distribution, they drive velocity.

They don’t just hope to scale, they engineer it.

Where does your brand stand? Take the Brand Growth Readiness Assessment and find out, in 10 minutes, which gaps are holding you back and what to fix first.

The wellness brands that will lead the next decade are being built right now. The question is whether you’ll be one of them. If you want to discuss your specific situation and get recommendations tailored to your brand’s stage and challenges: