You’re standing in the grocery aisle, staring at your competitor’s product. They have prime eye-level placement. Four facings to your one. An end-cap display. Meanwhile, your product is buried on the bottom shelf, and you just noticed you’re out of stock, again.

Here’s the brutal truth about retail: it’s a zero-sum game. Every inch of shelf space your competitor owns is space you don’t have. And while you’re focused on perfecting your recipe or refreshing your Instagram, they’re systematically taking market share you may never get back.

But here’s the good news: most F&B brands are terrible at competitive analysis. They’re looking at the wrong metrics, making emotional decisions, and competing on price when they should be competing on strategy.

This post reveals the exact framework successful brands use to analyze competitor performance and take market share.

Why Most Brands Get Competitor Analysis Wrong

Vanity metrics obsession: You’re tracking their Instagram followers while they’re tracking velocity and turn rates. Social media engagement doesn’t get you shelf space. Sales per square inch does.

Product-only focus: You compare ingredients and packaging design while ignoring their promotional strategy, pricing architecture, and distribution tactics—the things that actually drive retail success.

Snapshot thinking: You walk into a store once and make assumptions. What matters is trends over time: Are they gaining or losing space? Promoting more or less?

Guesswork over data: You rely on what you “see” in stores. Serious brands use syndicated data, category reports, and systematic audits.

Here’s what buyers actually care about: Can you move product? Will you generate profit per square foot? Your competitor’s packaging might be uglier, but if they’re turning 12x per year and you’re turning 6x, guess who’s getting the expansion?

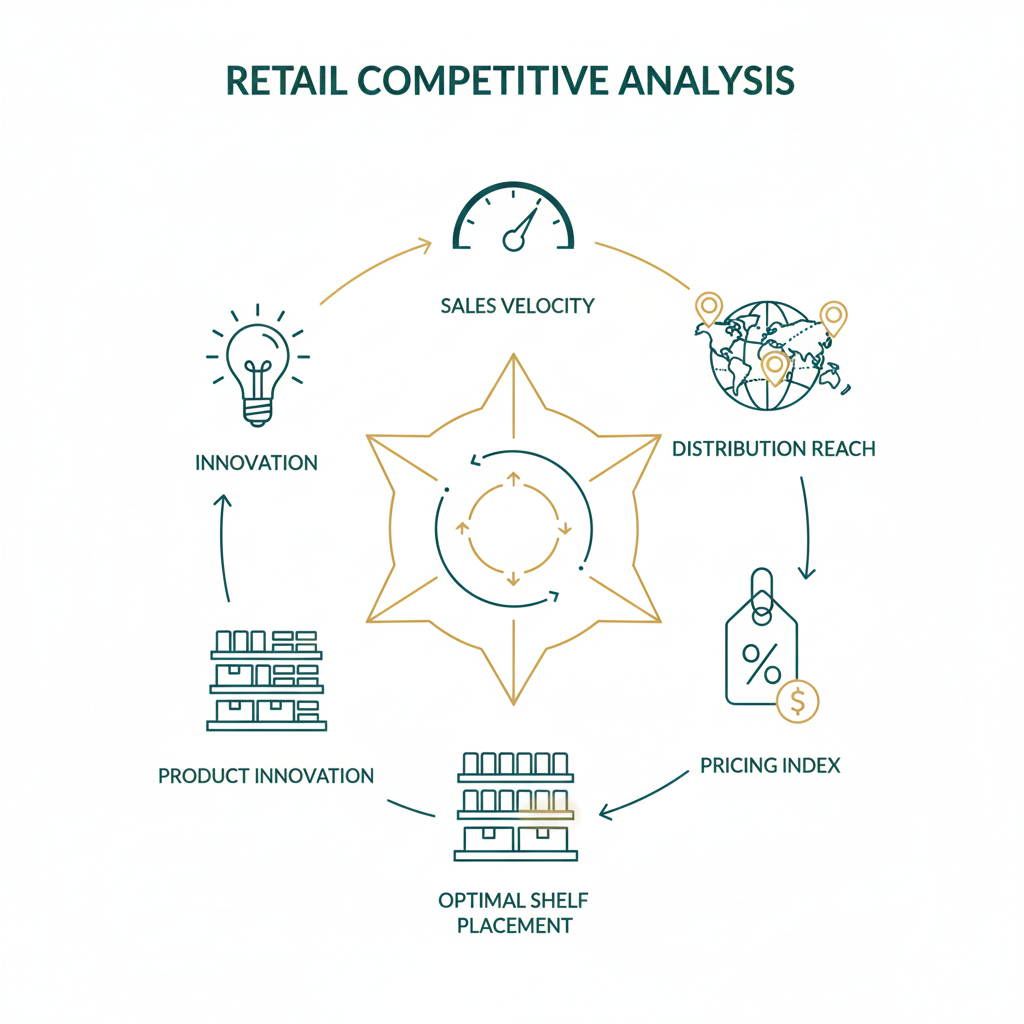

The 5 Critical Metrics That Actually Matter

1. Velocity & Turn Rate

What it is: How fast products move off the shelf, units per store per week or annual turn rate.

Why it matters: This is the #1 metric category managers use to decide expansions, facings, and delistings.

How to find it:

- SPINS, Circana, Nielsen (expensive but essential for national growth)

- Distributor reports showing comparative performance

- Store-level tracking (buy their product regularly, track restocking)

- Category reviews with buyers

Red flags your competitor is winning: Consistent stock-outs, increased facings, end-cap placements, expansion into new chains.

2. Distribution Footprint

Map their distribution vs. yours across:

- National chains

- Regional players

- Specialty/natural channel

- Convenience stores

- Club stores

What this reveals: Gaps where they’re present and you’re not, channels they’re ignoring (opportunities), and their growth trajectory.

Action: If they’re in accounts that rejected you, find out why. Sometimes it’s as simple as: they had data, you had hope.

3. Pricing Strategy & Promotional Calendar

Track their pricing like a hawk:

- Regular retail price

- Promotional price and frequency

- Types of promotions (BOGO, %, multi-buy)

- Timing patterns

Key insight: Heavy promotion means they’re either struggling with base velocity (opportunity) or aggressively buying share (threat).

What to do: You don’t need to match their intensity. But if they’re promoting every 4 weeks, promoting during their off-weeks gives you the spotlight.

4. Shelf Placement & Facings

Eye-level is buy-level.

Document on store walks:

- Shelf position (top, eye-level, bottom)

- Facings per SKU

- Total linear footage

- Secondary placement (end caps, displays)

What this tells you: More facings = stronger buyer relationship or proven performance. Track quarterly—are they gaining or losing space?

5. Innovation & SKU Strategy

Track their product pipeline:

- New launches

- Seasonal/limited editions

- Pack variations

- Line extensions

Why it matters: New SKUs signal investment and retailer confidence. If they’re innovating and you’re not, you’re losing relevance.

How to Get the Intelligence You Need

Free/Low-Cost Methods

Store audits: Visit 10-15 stores monthly. Document pricing, placement, promotions. Take photos. Talk to store managers.

Distributor conversations: Request velocity reports. Ask what’s moving in the category.

Retailer category reviews: When presenting to buyers, ask: “What are the top performers?” “What trends are you seeing?”

Trade publications: Progressive Grocer, Store Brands, Beverage Industry publish category insights.

Paid Intelligence (Worth It for National Growth)

SPINS/Circana/Nielsen: Industry standard for velocity, distribution, pricing data. Expensive ($10K-$50K+ annually) but essential for national chains.

Category management consulting: Deep insights, white-space analysis, strategic recommendations.

The Insider Advantage

The brands that win consistently build relationships with brokers, distributors, and category managers who share intel.

This is where 20 years of industry relationships compound. At Yventure, we’re not starting from zero. We’re tapping into two decades of pattern recognition and insider access.

Turning Data Into Action: The 4-Step Framework

Step 1: Identify the Gap

Create a competitive scorecard. You vs. top 3 competitors.

Rate each on:

- Velocity

- Distribution

- Pricing

- Promotion frequency

- Facings

- Innovation pipeline

Where are you losing? That’s where you focus.

Step 2: Diagnose Why They’re Winning

Don’t jump to solutions. Understand root causes.

Common reasons:

- Better brand story that resonates with buyers

- Proven velocity with data to back it up

- More aggressive trade spend

- Superior broker/buyer relationships

- First-mover advantage in the category

- Operational excellence (no stock-outs, on-time shipments)

Be brutally honest. If you’re losing, there’s a reason.

Step 3: Choose Your Battleground

You can’t compete everywhere. Pick ONE strategy:

Option A: Direct Confrontation

- Match or beat their promotional intensity

- Negotiate for equal facings with velocity data

- Launch competitive SKUs

When to use: You have similar resources and the gap is execution, not capability.

Option B: Flanking Maneuver

- Target channels they’re ignoring (natural vs. conventional, regional vs. national)

- Create a subcategory they can’t easily enter

- Dominate geographies where they’re weak

When to use: They’re bigger and better funded. You need differentiation.

Option C: Leapfrog Innovation

- Launch products that solve problems theirs don’t

- Use emerging trends they’re too slow to adopt

- Partner with retailers for exclusive innovation

When to use: You have R&D capability and the category is evolving.

Step 4: Execute and Measure

Set 90-day goals. Track weekly:

- Velocity changes

- Distribution wins

- Promotional performance

- Competitive movements

Adjust based on results. If it’s not working after 30 days, pivot. If it’s working, double down.

Critical point: Category leadership requires continuous monitoring. The brands that win long-term make intelligence gathering part of their operating rhythm.

Real-World Example: Regional Brand vs. National Giant

The setup: Mid-sized beverage brand losing ground to a national competitor with 3x the marketing budget and 3x the facings.

What we discovered:

- Competitor was promoting every 4 weeks, destroying margins

- Zero presence in independent retailers and specialty stores

- Base velocity (without promotion) was weak—only 6x turns vs. our client’s 9x

- No innovation pipeline

The strategy:

- Maintained premium positioning, promoted strategically every 8 weeks

- Aggressively pursued 2,000+ independent and specialty stores they ignored

- Launched a functional beverage line extension they couldn’t quickly replicate

- Used velocity data in every pitch: “We turn 9x at regular retail. They turn 6x without promotion.”

Results in 12 months:

- 5,000 new distribution points

- 40% increase in facings in existing accounts

- Became #2 in category in regional channel

- Maintained margins while growing

Key takeaway: You don’t need to match competitors dollar-for-dollar. You need to be smarter about where and how you compete.

The Biggest Mistake: Competing on Price Alone

When brands panic, they slash prices or over-promote.

Why this backfires:

- Destroys margins

- Trains consumers to wait for deals

- Makes you look desperate to retailers

- Creates a race to the bottom

The better approach: Compete on value; better brand story, proven velocity, innovation, superior service to retailers.

Remember: Retailers make money when you make money. A healthy brand is a long-term partner. A desperate brand is a delisting waiting to happen.

When You Need Expert Help

Signs you need a strategy partner:

- You’re collecting data but don’t know how to act on it

- Competitors are expanding and you’re stuck

- You’ve lost shelf space and don’t know why

- You want to move faster without trial-and-error

What a retail strategy partner brings:

- 20 years of category data and buyer relationships

- Pattern recognition from 100K+ store placements

- Objectivity (you’re too close to your own brand)

- Negotiating leverage and pitch expertise

The Bottom Line

Beating your competitors isn’t about having the best product. It’s about having better intelligence, a smarter strategy, and flawless execution. Right now, while your competitors are focused on their own business, you can be systematically studying theirs—and taking the market share they think is safe.

Your next steps:

- Start your competitive audit this week

- Track the 5 critical metrics

- Identify one gap you can exploit in 90 days

Category leaders aren’t born. They’re built through relentless competitive intelligence and strategic action.

Want to know what your competitors are doing that you’re not?

Book a free 15-minute strategy call and we’ll show you exactly where you’re losing ground, and how to take it back.